The iPad version offers the option of taking a photo of your W-2, after which TurboTax will attempt to scrape your wage and tax information and automatically enter the data in the appropriate TurboTax fields.

#Tax software for mac canada 2013 free

Like the App Store version of TurboTax, downloading the app is free and you only pay when it comes time to file your taxes. The TurboTax app on your iPad is exactly the same as the TurboTax app you purchase for your Mac from the App Store, from the interview process right down to the way you file your taxes.

TurboTax for the iPad offers all the same features as the desktop version of the application. The upside to this is that you can start something on your iOS device and continue it on your Mac when you get back to your desk. In fact, if you attempt to log into H&R Block’s Web portal while you are using the iPad app or vice versa, you will be automatically logged out of the other app. TurboTax is a standalone iOS app, while the H&R Block app connects to H&R Block’s Web-based tax filing tool. TurboTax 2013 and the H&R Block app both provide access to all the features of the desktop versions of their related desktop apps, with some subtle differences. If you’re an iPad user, filing taxes on your tablet is no different than filing taxes on your Mac. Both H&R Block and Intuit offer apps for the iPad, iPhone or iPod touch that, depending on your needs, will do the job and do it well. If you own an iOS device, it may be all you need to settle up with the taxman. Tuition fees or northern residents deductions are also free.Don’t have a Mac you can use to file your personal taxes? No problem.

#Tax software for mac canada 2013 license

Does not support Agriculture and FishingĮxcluded provinces : Quebec, Northwest Territories, Yukon and Nunavutġ Free for new customers, new immigrants, Seniors (70+), return with $25,000 or less income Ģ Free for students or total income below $25,000 by Apģ Free if total income is less than $20,000 Ĥ One free tax return until March 31,2014 ĥ Free for full-time student, who had spent six or more months in school in 2013 for a newcomer to Canada in 2013 for single / divorced / widowed / separated at end of the tax year, and total income is less than $25,000 for married / living common-law at the end of the tax year and the sum of both spouses’ total income is less than $30,000 Ħ License is required for returns under $31,000 total income (including seniors) or full-time students (4 months or more duration as indicated on your T2202A form) ħ Free if you are a newcomer to Canada, if your total family income is $20,000 or less, UFile ONLINE is absolutely free if you are reporting only employment income, If your total family income is $20,000 or less Ĩ Free for taxpayers with non self-employment income (employment income, pension income, investment income, other income…), and any type of standard deductions (personal amount, age amount, employment amount, disability amount…). Any return that involves a transfer of the former spouse of a disabled spouse. Tax Credits and Federal Logging Tax Credit. No limited partnership, including tax shelters. Software is listed in alphabetic order: Softwareĭoes not support Form T1273 – AgriStability / AgriInvest Programsĭoes not support Form T1273 -AgriStability / AgriInvest Programs NewcomersĮxcluded provinces : Quebec, Northwest Territories, Yukon and Nunavut Does not support Form T1273 – AgriStability / AgriInvest Programs Does not support returns with rental or self-employed business statements ĭoes not support Form T1273 -AgriStability / AgriInvest Programsĭoes not support Form T1273 -AgriStability / AgriInvest Programs 5 SFD per self-employment type.

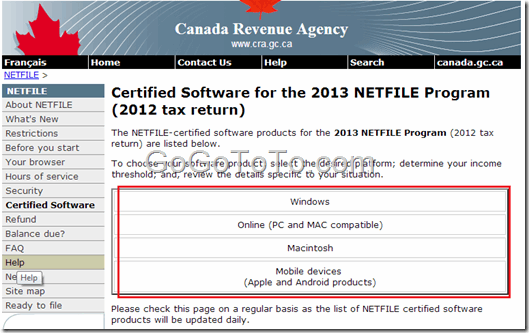

This is list of software can be used to file tax return for year 2013. Simple tax calculator published on this site can be used to calculate approximate taxes you need to pay, but you must use certified software to file your tax return to CRA. Latest Netfile software 2020 for income tax year 2019 can be found here

0 kommentar(er)

0 kommentar(er)